Date: January 07, 2019

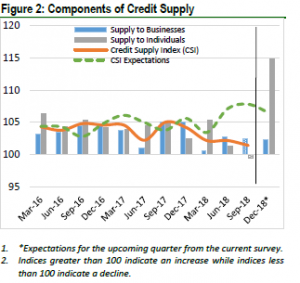

According to the Bank of Jamaica (BOJ), “Growth in credit availability, as measured by the Credit Supply Index (CSI), moderated when compared to the previous quarter.” It was further indicated that, “the CSI moderated to 101.4 from 102.2 in the previous quarter and reflected a decline in credit supply to individuals relative to the previous quarter, the effect of which was dampened by an increase in the growth in credit supply to businesses.

The rise in the supply of local currency credit made available moderated slightly due to growth in credit made available by lenders to the ‘Tourism and Distribution sectors.’ Foreign currency loans indicated a slight growth in credit supply which was reflected in the Entertainment, Tourism and Distribution sectors.

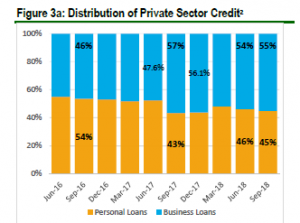

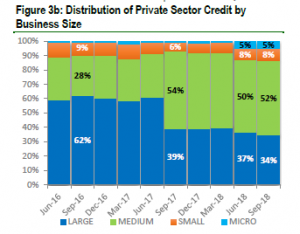

Additionally, the allocation of credit between businesses and personal loans remained grossly unchanged when compared to the previous quarter, with businesses accounting for the majority. With respect to businesses credit distribution, credit to medium sized businesses continued to account for the “lion’s” share of lenders business portfolio, with the proportion being a little more than that which was obtained in the prior quarter.

“The proportion of credit allocated to micro firms declined to 5.2 percent from 5.4 percent during the previous period,” BOJ stated. Furthermore, “there was also a decline in the proportion of credit made available to large firms to 34.4 percent from 36.7 percent.” Whereas, as highlighted by the BOJ, “the proportion of credit allocated to large-sized businesses declined while credit allocated to small businesses increased to 8.3 percent from 7.7 percent in the prior quarter.”

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.