Date: January 15, 2018

Ciboney Group Limited (CBNY), for the quarter ended November 30, 2017, reported an 87% decline in financial income to total $14,000 from $105,000 in November 30, 2016.

An exchange loss of $103,000 was realized relative to $159,000 gain for the corresponding period in 2016. Other operating expense for the period amounted to $2.46 million , 1% above last year’s $2.43 million.

Group Operating Expenses totalled $2.56 million as at November 30, 2017 relative to $2.27 million for the corresponding period in 2016 a 13% increase.

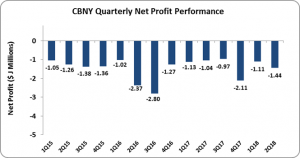

The company reported net loss before taxation of $2.55 million, this compares with the loss of $2.17 million in 2016. Net loss for the quarter amounted to $1.44 million, relative to a loss of $1.04 million reported for November 2016.

Net loss per share (LSP) was 0.26 cents for the quarter ended November 30, 2017 (2016: loss per share of 0.19 cents). The loss per share for the six months amounted to 0.47 cents versus a LPS of 0.40 cents. The trailing twelve months loss per a share is $0.01 cents. The number of shares used in the calculations is 546,000,000. CBNY stock price closed the trading period at a price of $0.35 on January 15, 2018.

Balance Sheet at a glance:

Total current assets as at November 30, 2017 amounted to $50.22 million, down from $55.81 million as at November 30, 2016. The main reason for the decline in total asset was Resale Agreement. Resale Agreement for the year contracted 92% compared to the $6.02 million reported in 2016.

Shareholders’ Deficit amounted to $50.21 million, an increase relative to the $44.59 million deficit reported in 2016. As such, the shareholder’s deficit per share stood at 9.2 cents as at November 30, 2017 (2016: 8.17 cents).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.